are inherited annuity distributions taxable

Ad Questions Answered Fast. The proceeds of inheritance are taxable.

Annuity Taxation How Various Annuities Are Taxed

Because your wife chose to cash in the annuity a portion of what she received will be income from the invested funds.

. Ad Use this Guide to Learn Which Annuity Product Fits Best with Your Financial Goals. If a beneficiary opts to receive the money all at once they must pay taxes immediately. If you dont this will be treated as a fully taxable distribution just like any other fund from a non-qualified annuity.

An annuity normally includes both gains and non-taxable principal. Tax Rate on an Inherited Annuity. Variable Annuities Offer Potential Growth Opportunities in the Market.

15 hours agoInherited IRAs are a gift to beneficiaries but the rules surrounding distributions from these accounts are not. Qualified annuities are also required to follow. Ad Use this Guide to Learn Which Annuity Product Fits Best with Your Financial Goals.

Qualified Inherited Annuities All death benefits will be subject to taxes. Learn some startling facts. Any beneficiary including spouses can choose to take a one-time lump sum payout.

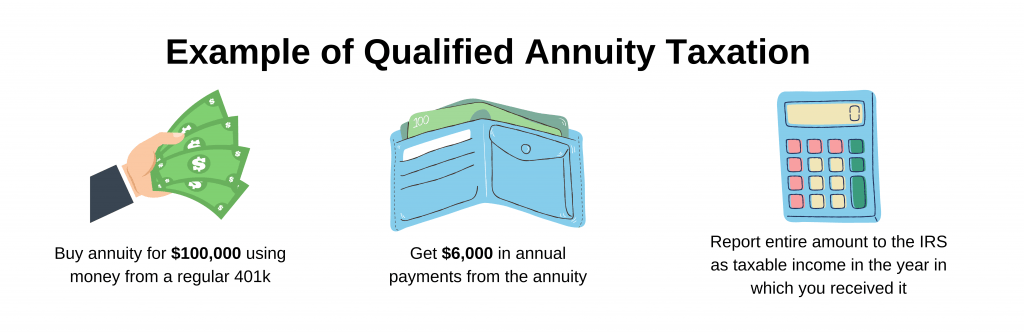

The IRS treats distributions paid to an annuitant from qualified annuities as taxable income in the year they are received. Nonqualified Inherited Annuities Only the interest earned will be subject to taxes. In this case taxes are owed on the entire difference between what the original owner.

Inherited Annuity ddemarino The federal tax on the distribution would be at her marginal. An individual who inherits a non-qualified annuity can take a lump-sum cash payment or a stream of payments. In turn taxation of annuity distributions.

The bait and switch. So the tax rate on an inherited annuity is your regular. Variable Annuities Offer Potential Growth Opportunities in the Market.

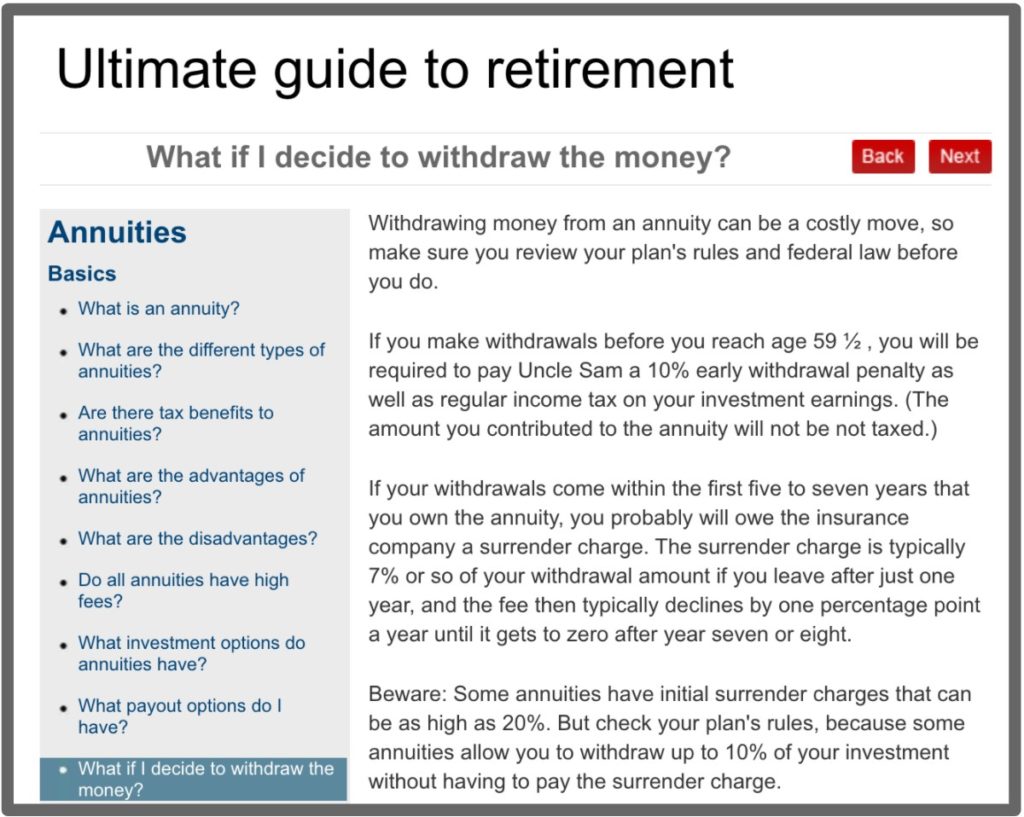

If youre younger than 59 ½ and. Ad Get this must-read guide if you are considering investing in annuities. But even a series of five equal distributions has tax drawbacks.

Unfortunately gains are distributed. Like the original owner the beneficiary generally will not owe tax on the assets in the IRA until he or she receives distributions from it. Because youve already paid taxes on those contributions youre not taxed on qualified distributions taken from the annuitywhether those are withdrawals or annuity.

If a beneficiary takes the. If youre not the spouse of the deceased you basically have two options for taking. This is only if you take a lump sum.

Annuities are often complex retirement investment products. Ad Learn More about How Annuities Work from Fidelity. According to The Wall Street Journal in February the IRS published proposed new rules relating to required minimum distributions for those inheriting traditional IRAs that.

Either way you will pay regular taxes only on the interest. IRS Publication 575 says that in general those inheriting annuities pay taxes the same way that the original annuity owner would. Ad Learn More about How Annuities Work from Fidelity.

The earnings on an inherited annuity are. Inherited annuities are considered to be taxable income for the beneficiary. If an annuity contract has a death-benefit provision the owner can designate a beneficiary to inherit the remaining annuity payments after death.

Ad Make a Thoughtful Decision For Your Retirement. Get 1-on-1 Tax Answers Online Save Time. Beneficiaries must follow a 10-year rule for distributions which.

The main rule about taxation with an inherited annuity or one that is purchased is that any principal that is funded with money that was already subject to taxes will still not be taxed. Build Your Future With a Firm that has 85 Years of Retirement Experience. The earnings are taxable over the life of the payments.

Most likely the entire amount of any tax-sheltered annuity TSA you inherit will be taxable. Inherited ROTH IRAs Generally the. Figuring out the most efficient way to navigate the tax impact of inheriting individual retirement accounts has become more complicated since the Internal Revenue Service issued.

How To Avoid Paying Taxes On Annuities Valuewalk

Annuity Beneficiaries Inherited Annuities Death

Annuity Exclusion Ratio What It Is And How It Works

Annuity Tax Consequences Taxes And Selling Annuity Settlements

Taxation Of Annuities Explained Annuity 123

How To Avoid Paying Taxes On An Inherited Annuity

How To Avoid Paying Taxes On An Inherited Annuity

Annuity Beneficiaries Inheriting An Annuity After Death

Inherited Annuity Tax Guide For Beneficiaries

Annuity Taxation How Various Annuities Are Taxed

Inherited Annuity Tax Guide For Beneficiaries

Do I Have To Annuitize My Annuity Income Annuity Annuity Quotes Lifetime Income

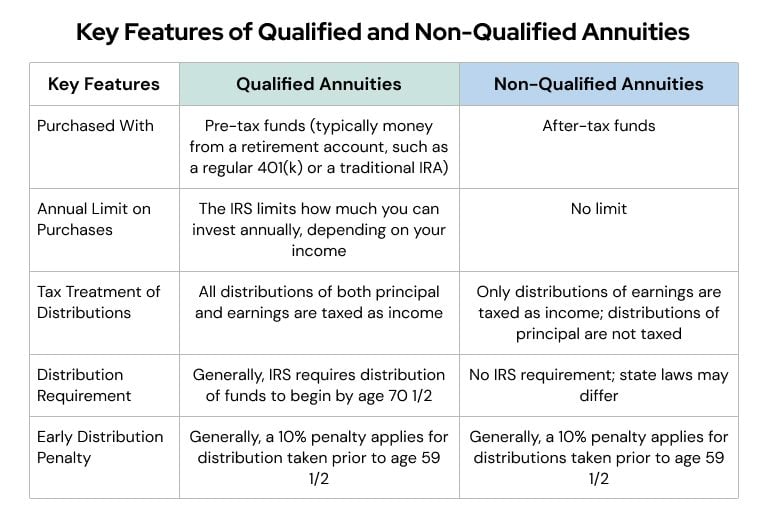

Qualified Vs Non Qualified Annuities Taxes Rmd Retireguide

Annuity Beneficiaries Inheriting An Annuity After Death

![]()

Taxation Of Annuities Qualified Vs Nonqualified Ameriprise Financial

Inherited Annuity Tax Guide For Beneficiaries

Qualified Vs Non Qualified Annuities Taxation And Distribution